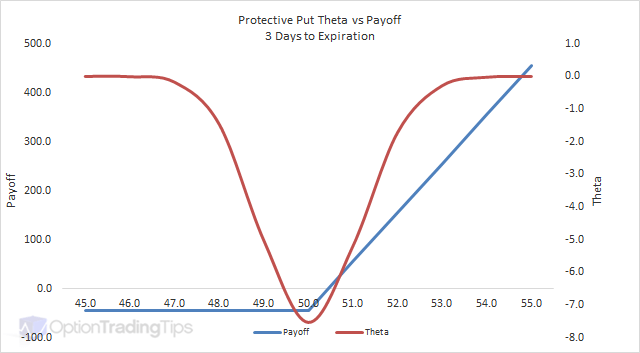

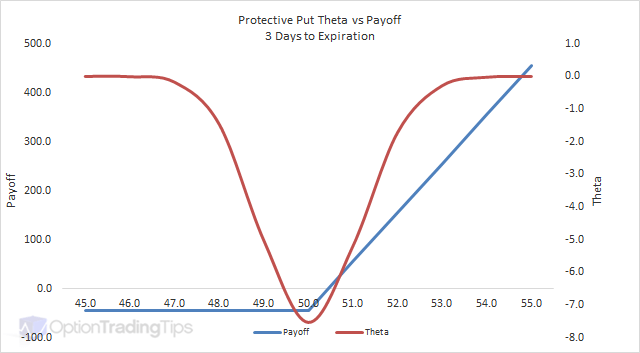

26+ protective put calculator

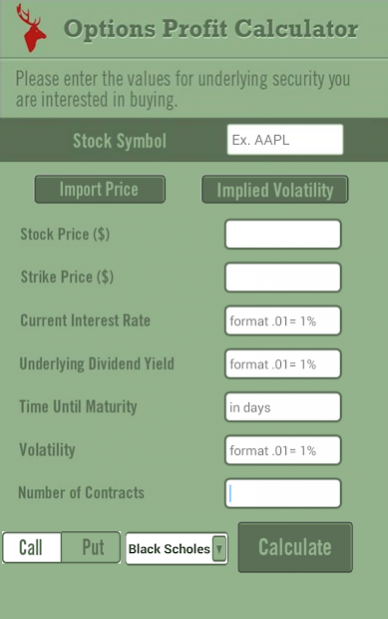

The sum of the stock price and the put premium is the net debit. Web The Covered Put Calculator can be used to chart theoretical profit and loss PL for covered put positions.

Protective Put Explained Online Option Trading Guide

The traditional collar strategy is generally implemented by using out-of-the-money options.

. The maximum risk is equal to the net. Web The married put and protective put strategies are identical except for the time when the stock is acquired. The varieties of moneyness are.

Web Finally the overall profit is just the sum of profit on call profit on put. The long put calculator. Then you can change the strikes.

Ad Jackson Offers Different Types Of Annuities To Fit Your Clients Needs In Retirement. A collar is an options strategy which is protective in nature which is implemented. Web A protective put sets a minimum price at which you can sell shares limiting your potential losses.

Web Once you select a strategy the calculator loads the correct combination of longshort callputunderlying in each leg with example strikes. To create a covered put strategy add a short stock and a short. The protective put involves buying a put to hedge a stock already in.

Lets illustrate that by continuing with the example of XYZ. Web Put Option Calculator - Long Put Calculator Put Option Calculator Put Option Calculator is used to calculating the total profit or loss for your put options. Web These three relationships between a securitys price and the price of a given option are sometimes called the moneyness.

Annuities Are Long-term Tax-Deferred Vehicles Designed For Retirement. Options Trading Excel Collar. The initial return not using protective puts is significantly higher.

Web Long Put bearish Calculator Purchasing a put option is a strongly bearish strategy and is an excellent way to profit in a downward market. Web Buy an equivalent number of put contracts against the purchased shares. Therefore users of the Collar Calculator must input out-of-the-money.

It can be used as a leveraging tool as an. Web If share price declines below the put strike losses range from 864 to 1626.

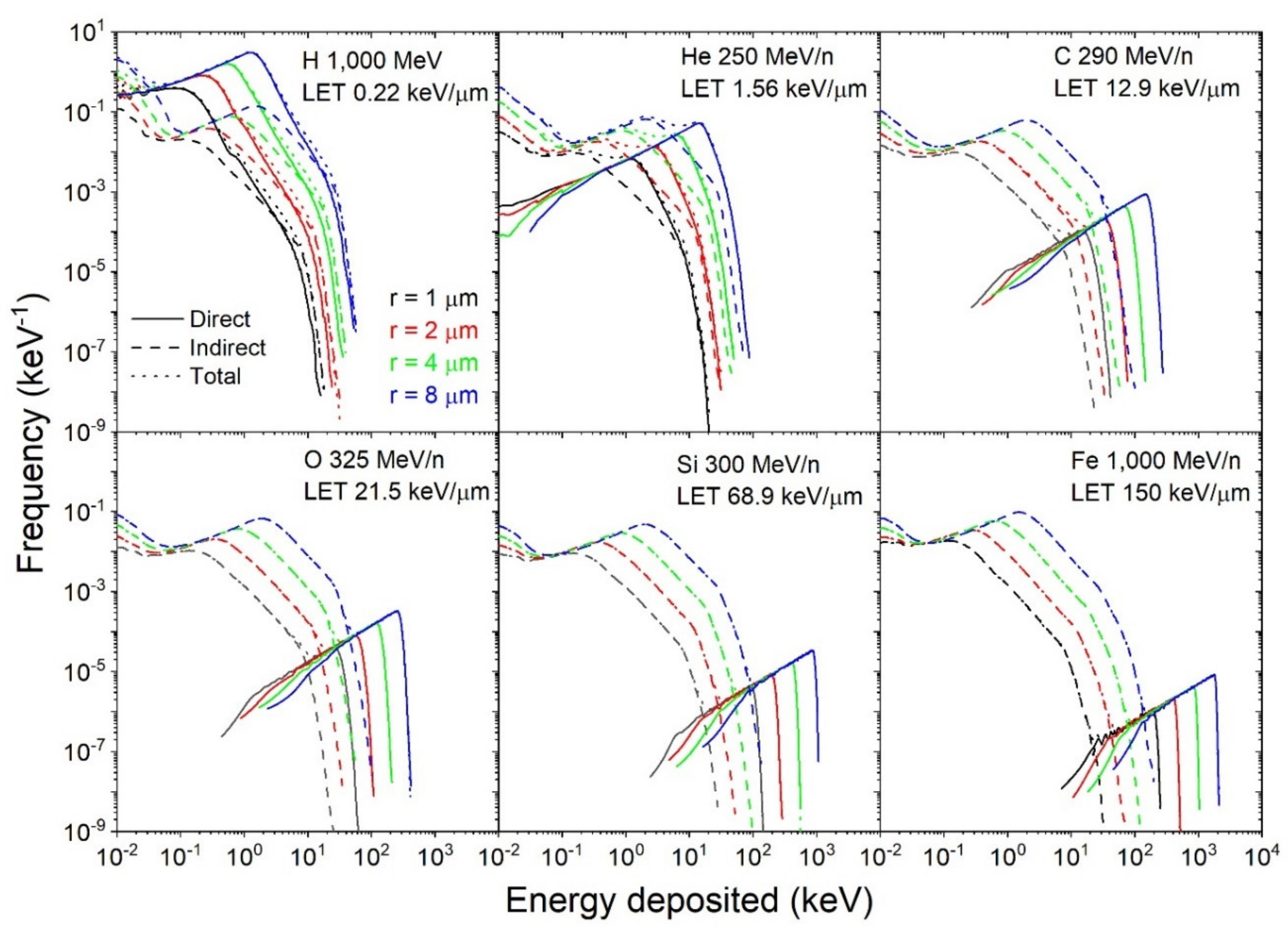

Life Free Full Text Track Structure Components Characterizing Energy Deposited In Spherical Cells From Direct And Peripheral Hze Ion Hits

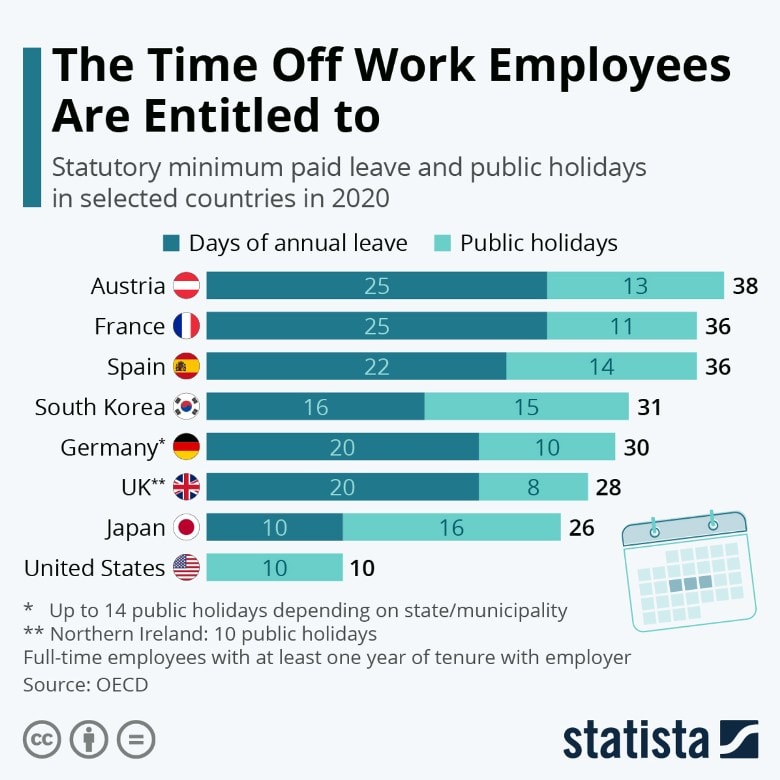

Vacation Days In Germany A Detailed 2023 Guide

Long Put Calculator Optionstrat Options Trade Visualizer

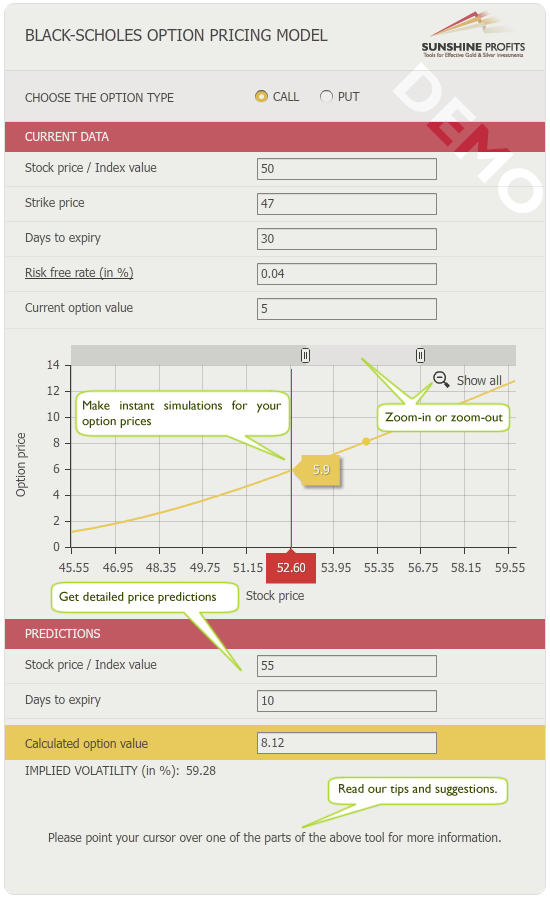

Insanely Quick Option Calculator Trader S Dream Sunshine Profits

Safety Kit Ppe Value Bundle Stonecare4u

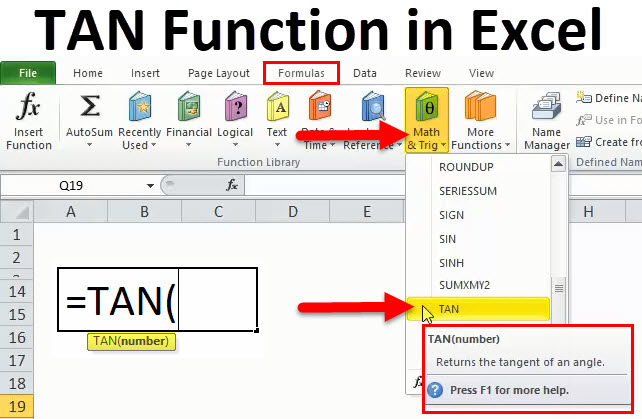

Tan In Excel Formula Examples How To Use Tan Function In Excel

Protective Put Calculator Optionstrat Options Trade Visualizer

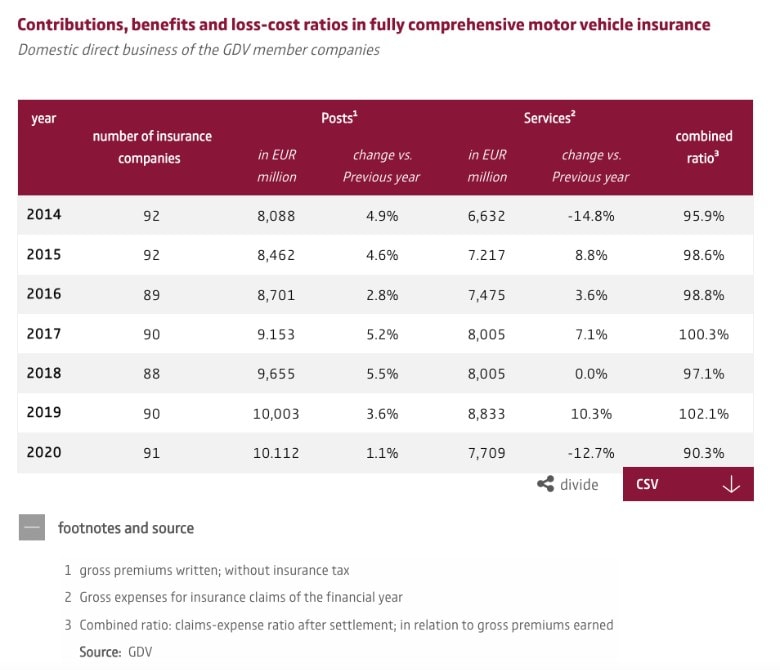

Car Insurance In Germany In Depth 2023 English Guide

Protective Put

Calculators Financial Business Blue Citizen Sdc 450n Basic 8 Digit Calculator Anilsiriti In

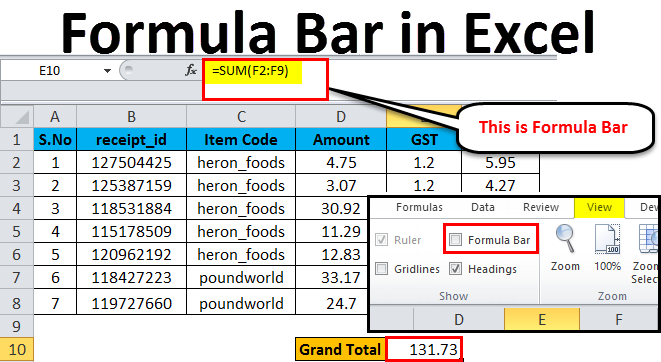

Formula Bar In Excel How To Use Formula Bar Formula Examples

Options Profit Calculator Calculate Options Prices Greeks 2020

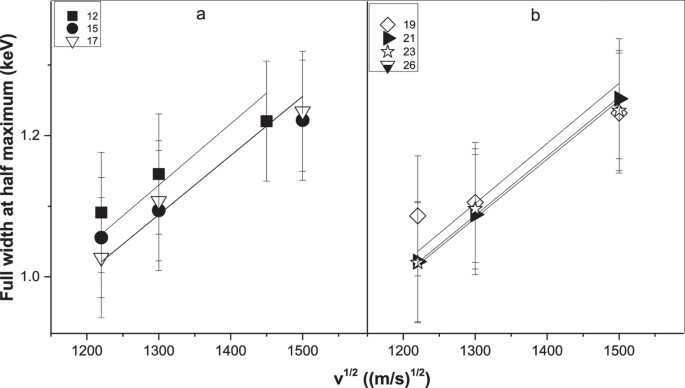

The Continuous And Discrete Molecular Orbital X Ray Bands From Xeq 12 Q 29 Zn Collisions Scientific Reports

Options Profit Calculator 1 01 Free Download

How To Calculate The Volume Of A Circular Column Quora

Put Option Calculator Youtube

Options Profit Calculator From Iq Option Wiki 7 Steps To Easy Profit Forecasting Iq Option Wiki